Learn about the taxation of Real Estate Investment Trusts (REITs) in Kenya. Understand the tax implications and maximize your returns in this lucrative sector.

Are you a Kenyan investor looking to enter the real estate market? If so, it's crucial to understand the ins and outs of taxation for Real Estate Investment Trusts (REITs). This article aims to provide you with a comprehensive overview of what you need to know about the taxation of REITs in Kenya. By understanding the tax implications, you can make informed decisions and maximize your returns in this lucrative sector. So, let's dive in and explore the world of REIT taxation together!

Definition of Real Estate Investment Trusts (REITs)

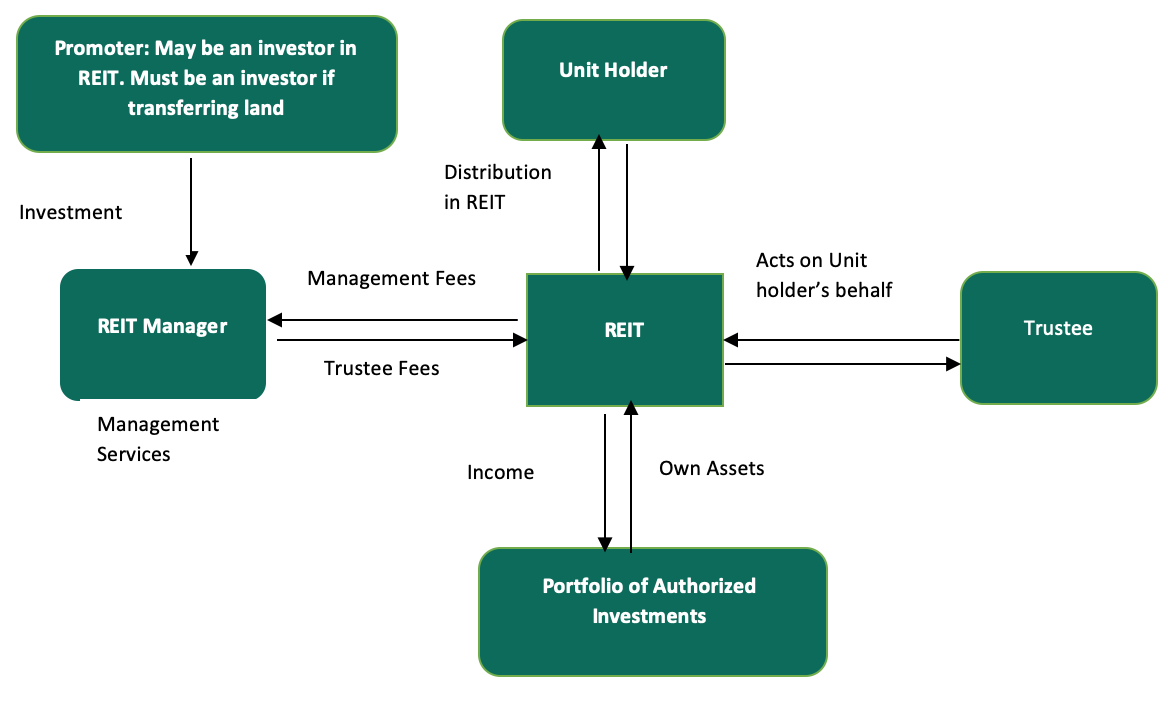

Real Estate Investment Trusts (REITs) are investment vehicles that allow individuals to invest in real estate without having to directly own and manage properties. REITs pool funds from multiple investors, which are then used to invest in income-generating real estate properties, such as shopping malls, office buildings, apartments, and hotels. These investments can be made in various forms, including equity REITs, mortgage REITs, and hybrid REITs.

Overview of REITs

REITs provide a way for investors to participate in real estate markets, benefit from rental income and potential appreciation of property values, and diversify their investment portfolios. By investing in REITs, individuals can gain exposure to real estate assets that may not be accessible to them as individual investors. Additionally, REITs offer the potential for regular dividend income, as they are required to distribute a significant portion of their earnings to shareholders.

This image is property of commercialpropertykenya.com.

Legal framework in Kenya

In Kenya, the establishment and operation of REITs are regulated by the Capital Markets Authority (CMA). The legal framework for REITs is provided under the Capital Markets (Real Estate Investment Trusts) Regulations, 2013. These regulations prescribe the requirements and obligations that companies must fulfill in order to qualify as REITs in Kenya.

Types of REITs

There are different types of REITs that investors can consider in Kenya. One type is equity REITs, which own and operate income-generating properties directly. These properties can include residential, commercial, or industrial real estate. Another type is mortgage REITs, which invest in mortgages or mortgage-backed securities, thereby earning income from the interest generated. Hybrid REITs combine both equity and mortgage investments.

This image is property of alakonyalaw.co.ke.

Taxation of REITs in Kenya

Understanding the taxation of REITs in Kenya is crucial for investors considering these investment vehicles. There are several aspects of REIT taxation that should be taken into account when evaluating the potential returns and tax implications.

REIT as a pass-through entity

One key benefit of investing in REITs is that they are structured as pass-through entities for tax purposes. This means that the income generated by the REIT is not subject to corporate income tax at the entity level. Instead, the income is passed through to the shareholders, who are then responsible for reporting and paying taxes on their share of the distributed income.

Corporate income tax

While the REIT itself is exempt from corporate income tax, shareholders are subject to taxation on the distributed income they receive from the REIT. The income is taxed at the individual level at the prevailing personal income tax rates.

Withholding tax on distributions

Distributions made by a REIT to its shareholders are subject to withholding tax. The current withholding tax rate on dividends in Kenya is 5%, which is deducted by the REIT before making the distribution. Shareholders may be able to claim a tax credit for the withholding tax paid when filing their income tax returns.

Capital gains tax

When a REIT sells a property and realizes a capital gain, it may be subject to capital gains tax. The current capital gains tax rate in Kenya is 5% for individuals and 20% for companies. However, there are certain exemptions and reliefs available for REITs, depending on the nature and duration of their investments.

Stamp duty

REITs are generally exempt from stamp duty on the acquisition or disposal of property. This exemption can help reduce transaction costs for REITs and potentially increase net returns for investors.

Value Added Tax (VAT)

REITs are generally not subject to VAT on property rental income. However, certain services provided by REITs, such as hotel accommodation or property management services, may be subject to VAT.

Requirements for a Company to Qualify as a REIT

In order for a company to qualify as a REIT in Kenya, it must meet certain requirements as set forth by the Capital Markets Authority. These requirements are designed to ensure that REITs operate in a transparent and accountable manner, and that they provide investors with sufficient protection and benefits.

Minimum shareholding

To qualify as a REIT, a company must have at least 100 shareholders, each holding at least 100 shares. This requirement ensures that the ownership of the REIT is widely spread and provides investors with the opportunity to participate in the benefits of real estate investments.

Income distribution requirements

REITs in Kenya are required to distribute at least 90% of their rental income to shareholders annually. This distribution is typically made in the form of dividends. By requiring REITs to distribute a significant portion of their earnings, the regulations aim to provide investors with a regular income stream and to align the interests of the REIT with those of its shareholders.

Investment restrictions

REITs are subject to certain investment restrictions to ensure that they maintain a diversified portfolio of real estate assets. For example, a REIT cannot invest more than 25% of its total assets in a single property, or more than 10% of its total assets in uncompleted projects.

Asset diversification

In addition to investment restrictions, REITs are required to maintain a diversified portfolio of assets. This means that a REIT must not allocate more than 40% of its assets to any single type of property, such as residential, commercial, or industrial properties. Diversification helps to mitigate risks and provides investors with exposure to different segments of the real estate market.

Independent valuations

To ensure transparency and fairness in valuing their properties, REITs are required to obtain independent valuations of their properties at least once every three years. These valuations provide investors with confidence in the accuracy of the property values reported by the REIT and help prevent potential conflicts of interest.

This image is property of cytonnreport.com.

Tax Benefits of Investing in REITs

Investing in REITs in Kenya can offer several tax benefits to investors, compared to other forms of real estate investments.

Exemption from corporate income tax

One of the key advantages of investing in REITs is the exemption from corporate income tax at the entity level. This means that the income generated by the REIT is not subject to taxation before it is distributed to shareholders. Investors can enjoy the potential returns without the burden of corporate income tax.

Tax-efficient distribution of income

REITs are required to distribute a significant portion of their earnings as dividends to shareholders. These dividends are subject to personal income tax, but they may be taxed at lower rates compared to other types of investment income. This tax-efficient distribution structure can help enhance the after-tax returns for investors.

Capital gains tax benefits

When REITs sell a property and realize a capital gain, they may be eligible for certain exemptions or reliefs from capital gains tax. These exemptions and reliefs are subject to specific conditions, such as the duration of the investment or the use of the proceeds. By taking advantage of these benefits, REITs can potentially increase their net returns and, in turn, benefit their shareholders.

Deferral of tax on reinvested income

If a REIT reinvests its earnings into the acquisition or development of new properties, the shareholders may be able to defer the tax on the distributed income that is reinvested. This deferral can provide investors with additional flexibility to grow their investments and potentially defer the tax liability to a later date when the income is realized.

Reporting and Compliance Obligations for REITs

In order to ensure transparency and compliance with tax and regulatory requirements, REITs in Kenya have certain reporting and compliance obligations.

Financial reporting requirements

REITs are required to prepare and submit financial statements in accordance with the International Financial Reporting Standards (IFRS). These financial statements provide information about the financial performance and position of the REIT, including its income, expenses, assets, and liabilities. By adhering to these reporting standards, REITs demonstrate their commitment to transparency and accountability.

Income tax return filings

REITs are required to file annual income tax returns with the Kenya Revenue Authority (KRA). These returns provide details of the REIT's income, expenses, and distributions, allowing the tax authorities to determine the tax liability of the REIT and its shareholders. Timely and accurate filing of income tax returns is essential to comply with the tax laws and to avoid potential penalties or interest charges.

Withholding tax obligations

REITs are responsible for deducting and remitting withholding tax on dividends distributed to shareholders. The withholding tax rate is currently 5% in Kenya. The REIT must ensure timely and accurate withholding tax deductions and remittances to comply with the tax law requirements.

Stamp duty compliance

REITs are generally exempt from stamp duty on the acquisition or disposal of properties. However, they may still be subject to stamp duty on certain transactions, such as the transfer of shares or other securities. REITs must comply with stamp duty requirements by assessing the applicable stamp duty and remitting the duty to the relevant authorities.

VAT registration and reporting

REITs may be required to register for Value Added Tax (VAT) if they provide certain taxable services, such as hotel accommodations or property management services. Registered REITs must comply with VAT reporting requirements and collect and remit VAT on taxable supplies, as specified by the tax laws.

This image is property of www.buyrentkenya.com.

Comparison of REITs with Other Real Estate Investment Vehicles

REITs offer distinct advantages and disadvantages compared to other real estate investment vehicles in Kenya.

Traditional real estate investments

Investing directly in real estate properties requires significant capital, effort, and expertise. Individual investors may face challenges in identifying suitable properties, negotiating deals, and managing the properties effectively. Moreover, real estate investments can be illiquid, making it difficult for investors to easily buy or sell properties. REITs provide a more accessible and liquid alternative to direct real estate investments.

Real estate partnerships

Real estate partnerships involve pooling funds from multiple investors to acquire and manage properties. While partnerships can offer investors more control and involvement in the decision-making process, they also come with increased responsibilities and risks. Partnerships may require active management and ongoing coordination among partners. REITs, on the other hand, allow investors to passively invest in a diversified portfolio of properties, leaving the management to professionals.

Real estate companies

Investing in real estate development or construction companies can offer exposure to the real estate sector. However, these companies may be more prone to market volatility and economic downturns, as their performance is closely tied to the broader real estate market. In contrast, REITs can provide investors with more stability and diversification, as they invest in income-generating properties that can generate consistent rental income.

Potential Risks and Challenges of Investing in REITs

While REITs offer several benefits, investors should also be aware of the potential risks and challenges associated with these investment vehicles.

Market and economic risks

REITs are influenced by market and economic conditions, including interest rates, property market trends, and overall economic performance. Changes in these factors can affect property values, rental income, and investor demand for REITs. Fluctuations in property values or rental income can impact the returns and value of the REIT investment.

Liquidity risks

Although REITs are generally considered more liquid than direct real estate investments, there can still be liquidity risks associated with REITs. In times of market volatility or economic uncertainty, investors may face difficulties in selling their shares or exiting their investments. The liquidity of a REIT can depend on factors such as the demand for the shares and the availability of buyers in the market.

Management risks

The success of a REIT depends heavily on the expertise and capabilities of its management team. Investors should assess the track record and qualifications of the management team before investing in a REIT. Poor management decisions or lack of effective operational strategies can adversely affect the financial performance and long-term viability of the REIT.

Regulatory and legal risks

REITs are subject to regulatory oversight and compliance obligations imposed by the Capital Markets Authority. Failure to comply with the regulations or changes in the regulatory environment can have significant implications for the REIT and its investors. Additionally, changes in tax laws or government policies related to real estate investments can impact the taxation and returns associated with REITs.

This image is property of alakonyalaw.co.ke.

Tips for Choosing and Evaluating REIT Investments

When selecting and evaluating REIT investments in Kenya, there are several factors to consider to make informed investment decisions.

Research and analysis

Thorough research and analysis are essential when considering REIT investments. Investors should review the financial performance, track record, and investment strategy of the REIT. They should also assess the quality and potential growth of the underlying real estate assets in the REIT's portfolio. By conducting comprehensive research and analysis, investors can gain insights into the risks and rewards associated with the investment.

Assessing REIT performance

Investors should evaluate the historical performance of the REIT, including its rental income, dividends, and total returns. Comparing the performance of the REIT to its peers and benchmark indices can provide a better understanding of its relative performance. Additionally, investors should consider the stability and consistency of the REIT's income streams, as well as its ability to generate long-term value for shareholders.

Considering diversification

Diversification is an important risk management strategy when investing in REITs. Investors should consider investing in REITs that have a diversified portfolio of properties across different locations and property types. Diversification can help mitigate risks associated with individual properties or segments of the real estate market, and provide investors with exposure to a broader range of investment opportunities.

Evaluating management team

The competence and experience of the management team can significantly impact the success of a REIT. Investors should assess the track record and expertise of the management team, including their knowledge of the real estate market and their ability to execute the REIT's investment strategy. A strong and capable management team can make informed decisions, manage risks effectively, and maximize returns for shareholders.

Case Study: Successful REIT Investments in Kenya

Examining successful REIT investments in Kenya can provide valuable insights and lessons for investors considering these investment vehicles.

Overview of successful REITs

Kenya has witnessed the establishment and growth of successful REITs in recent years. These REITs have demonstrated strong financial performance, consistent income distributions, and value appreciation for their shareholders. Successful REITs in Kenya have invested in a variety of real estate assets, including commercial buildings, shopping centers, and industrial properties.

Factors contributing to their success

Several factors have contributed to the success of REITs in Kenya. Strong investment strategies, effective property management, and timely market analysis have helped these REITs identify and capitalize on attractive real estate opportunities. Transparency, regular communication with investors, and adherence to regulatory requirements have also played a role in building trust and confidence among shareholders.

Lessons for investors

Investors can learn from the success of REITs in Kenya by focusing on the fundamental principles of real estate investing. Conducting thorough due diligence, diversifying investments, and having a long-term investment horizon can contribute to successful outcomes. Additionally, understanding and aligning with the regulatory framework, staying informed about market trends, and engaging with the management team can help investors make informed decisions and maximize their returns.

Conclusion

Real Estate Investment Trusts (REITs) in Kenya offer investors a unique opportunity to participate in the real estate market and benefit from rental income and potential appreciation of property values. By understanding the legal framework, taxation, requirements, benefits, reporting obligations, and risks associated with REIT investments, investors can make informed decisions and maximize their returns.

It is important for investors to evaluate the performance, strategy, and management of REITs before making investment decisions. Thorough research, analysis, and assessment of these factors can help identify REITs that align with individual investment goals and risk tolerance.

Investing in REITs can provide attractive tax benefits, including exemption from corporate income tax, tax-efficient distribution of income, and potential capital gains tax benefits. However, investors should also be aware of the risks and challenges associated with REIT investments, including market volatility, liquidity risks, management risks, and regulatory and legal risks.

By considering these factors and tips, investors can navigate the world of REIT investments in Kenya and potentially benefit from the opportunities presented by this investment vehicle.

0 Comments